Table of Contents

- It's Official: 401(k) Contribution Limits for 2025 Are Here

- The IRS Announces New 401(k) Plan Limits for 2024 – Sequoia

- Critical 2025 Solo 401k Withdrawal Rules: Don’t Get Caught Off Guard ...

- 2024 IRA Contribution And Income Limits: What Retirement Savers Need To ...

- 2025 401(k) and IRA contribution limits: What you need…

- 401k 2025 Contribution Limit Chart 2025 - Coleent Hornton

- Retirement plans are changing in 2025: What to know - ABC News

- 2024 Irs 401(K) Income Limits - Astra Candace

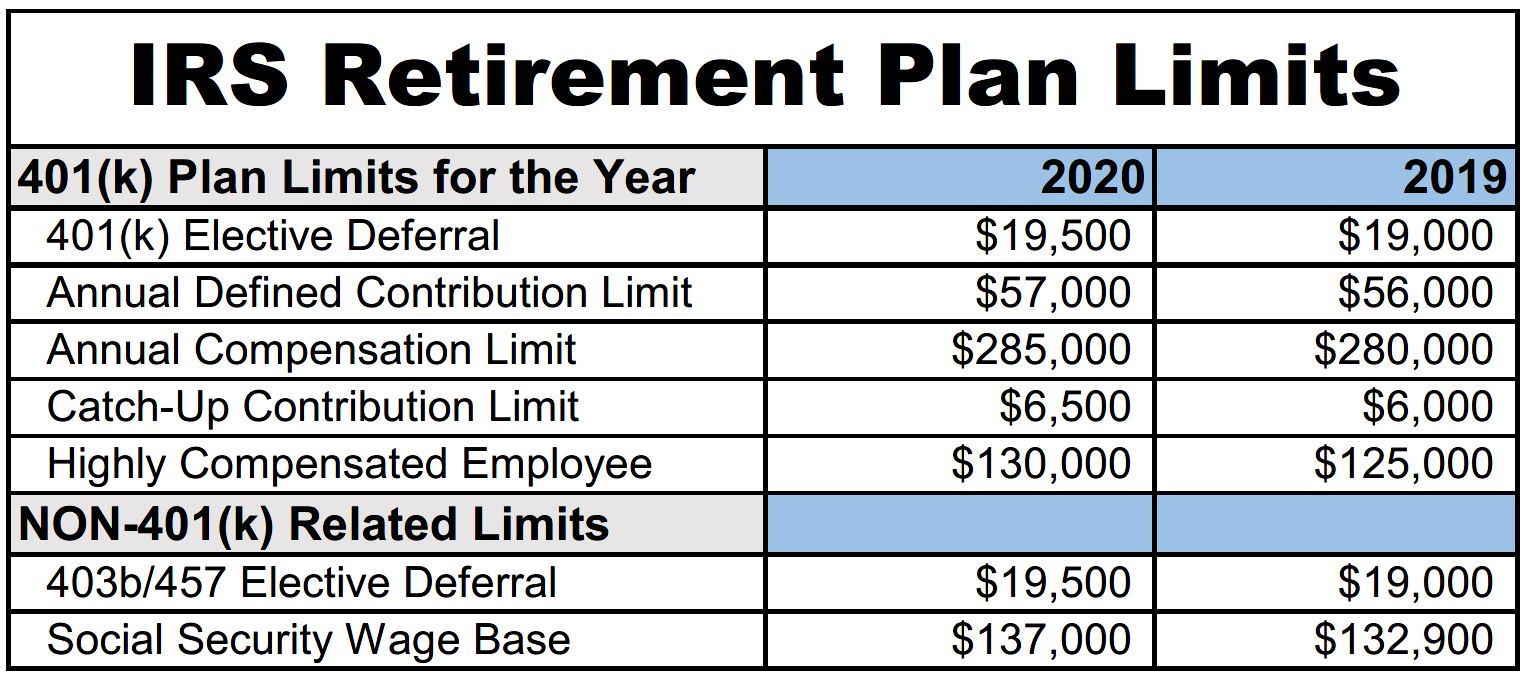

- Retirement Plan Contribution Limits Will Increase in 2020 | Global ...

- IRS unveils IRA contribution limits for 2025 – NBC 5 Dallas-Fort Worth

Key Changes for 2025

Thresholds for High-Income Individuals

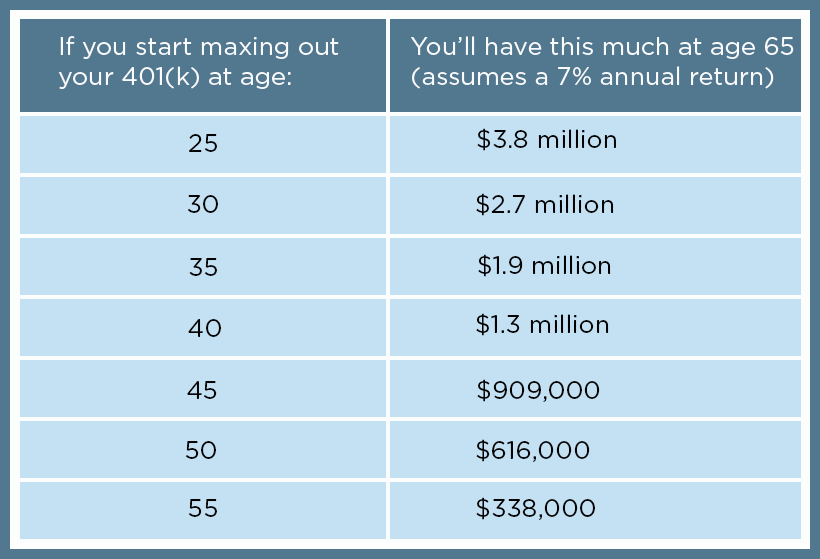

Impact on Retirement Planning

The updated dollar limits and thresholds can have a significant impact on retirement planning. Individuals who are eligible to contribute to a retirement plan should review their current contributions and consider increasing them to take advantage of the new limits. Employers should also review their retirement plan offerings to ensure they are compliant with the new regulations. The IRS's announcement of the 2025 retirement plan dollar limits and thresholds provides valuable guidance for individuals and employers. By understanding the new limits and thresholds, Americans can make informed decisions about their retirement planning and take advantage of the tax benefits available to them. Whether you're just starting to save for retirement or are nearing the end of your working years, it's essential to stay up-to-date on the latest changes and adjust your strategy accordingly.For more information on the 2025 retirement plan dollar limits and thresholds, visit the IRS website. Consult with a financial advisor or tax professional to determine how these changes may impact your individual circumstances.

Keyword Tags: 2025 retirement plan updates, IRS announcements, dollar limits, thresholds, retirement planning, 401(k), 403(b), thrift savings plans, IRA contributions, high-income individuals, tax benefits.